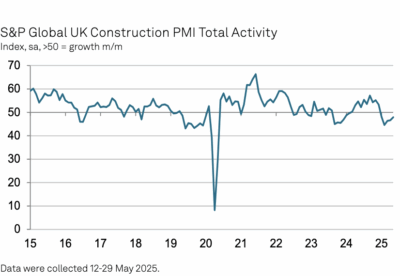

The bellwether S&P Global UK Construction Purchasing Managers’ Index posted 47.9 in May- up from 46.6 in April – to signal the slowest reduction in output volumes since January.

Total new work received by UK construction companies decreased to the least marked extent for four months in May with commercial the best performing sector.

Tim Moore, Economics Director at S&P Global Market Intelligence, said: “The construction sector continued to adjust to weaker order books in May, which led to sustained reductions in output, staff hiring and purchasing.

“However, the worst phase of spending cutbacks may have passed as total new work fell at a much slower pace than the near five-year record in February.

“Housing activity was the weakest-performing segment in May as demand remained constrained by elevated borrowing costs and subdued confidence. Commercial work was close to stabilisation after a marked decline in April, suggesting that fears about domestic economic prospects have abated after the initial shock of US tariff announcements.

“Output growth expectations across the UK construction sector recovered to the highest so far in 2025. Survey respondents mostly cited a general improvement in sales projections as well as a potential tailwind from falling interest rates over the year ahead.

“On the inflation front, stubbornly high input price pressures were recorded in May, although the overall rise in purchasing costs was the least marked for four months. Many firms noted that suppliers continued to pass through greater payroll costs.

“Rising wages, squeezed margins and subdued demand weighed on construction employment, despite a brighter outlook for business activity. Job shedding was the steepest since August 2020, while subcontractor usage decreased to the greatest extent for five years.

.gif)